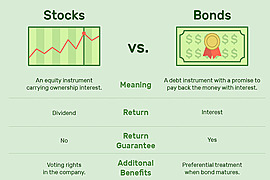

Stocks Vs Bonds

While stocks are equities, bonds are known as debt securities. Although both stocks and bonds are popular investment options, there are several key differences to be aware of before investing your money. Stocks are ownership shares in a company, while bonds are a loan to a company or government. In general, the role of stocks is to provide long-term growth potential and the role of bonds is to provide an income stream.

- A common view on Wall Street is that equities always do better than bonds and cash over a multi-decade holding period

- In reality though, this depends on the start date

- Stocks ar though to do better because they have more risk (and should garner a higher return)

- When short-term rates are near or higher than inflation, bonds are more popular

- allow savers to maintain purchasing power without taking lots of risk

- can drive down the demand for stocks

- When short term rates are low, saves are forced into longer-term debt securities or stocks to try and maintain purchasing power

- Bonds provide a relatively low but stable return

- Stocks provide a lower return than bonds (dividends), but stable return

- Stock prices are quite volatile to economic and deflationary/inflationary cycles

- Bonds or stocks can be better depending on when buying Bonds and stocks in the broader economic and inflationary/deflationary cycles