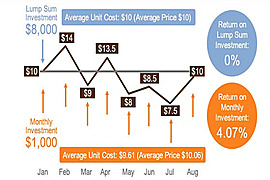

Dollar Cost Averaging

Dollar Cost Averaging is when you buy equal dollar amounts of the same investment on a predetermined schedule

- Logic behind dollar cost Averaging:

- You can expect a stocks price to vary over a period of time (sometimes lower, sometimes higher)

- helps you reduce risk of short-term stock price movements

- automatically encourages you to buy more share when prices are lower and less share when prices are higher

- takes the emotion out of when to enter a trade

- can help you outperform during bear markets and

- Compared it to buying the entire amount of an investment at one time

- It it NOT buying a fixed number of shares on a regular basis

Dollar Cost Averaging Cautions

- You may end up worse off if a stock is in a long-term bull market and keeps going up

- You may have to pay more in trading costs (more transactions)

- You may miss out on collecting dividend payments by waiting to purchase

Dollar Cost Averaging Example

Instead of buying $10,000 worth of a stock in one order, purchase $1,000 of the same stock every month for 10 months